Filed Pursuant to Rule 433(f)

Free Writing Prospectus dated March 24, 2011

Relating to Preliminary Prospectus

Supplement dated March 21, 2011

and Prospectus dated July 28, 2010

Registration Statement No. 333-168180

Gulfport Energy Corporation

On March 22, 2010, the online publication of Investor’s Business Daily posted an online article (the “Article”) concerning Gulfport Energy Corporation (the “Company”). The full text of the online article is reproduced in Exhibit A attached hereto.

The Article was not prepared by or reviewed by the Company or any other offering participant prior to its publication. The publisher of the Article is not affiliated with the Company. The Company made no payment and gave no consideration to the publisher in connection with the publication of the Article or any other articles published by this publisher concerning the Company. With the exception of statements and quotations attributed directly to Mr. James Palm, Chief Executive Officer of the Company, or derived from the Company’s public filings with the Securities and Exchange Commission (“SEC”), the Article represented the author’s opinion and the opinion of others, which are not endorsed or adopted by the Company or any other offering participant.

You should consider statements in the Article or contained herein only after carefully evaluating all of the information in the Company’s registration statement on Form S-3 (File No. 333-168180), which the Company filed with the SEC on July 16, 2010, the accompanying prospectus dated July 28, 2010, in the related preliminary prospectus supplement dated March 21, 2011, including the risks described therein, and in the Company’s Annual Report on Form 10-K for the year ended December 31, 2010, filed on March 14, 2011 (“Form 10-K”) and the other documents incorporated by reference into such registration statement.

Corrections and Clarifications

For purposes of correction and clarification, the Company notes the following:

| • | The Article stated that “[Mr. Palm] believes he can continue to increase Louisiana output. ‘We can continue to grow 20% to 25% in annual production out of southern Louisiana,’ the CEO said.” Such statement was intended to reflect Company management’s belief in the growth potential of its interests in South Louisiana. It is the Company’s expectation, however, that in the near term and under its currently proposed 2011 capital budget, growth in production will come primarily from its expanded drilling program focused on its Permian Basin properties in West Texas and increased production from Southern Louisiana. |

| • | With respect to the Company’s minority investment in two Thailand natural gas ventures, the Article stated that in drilling an exploratory well by one of the ventures in which the Company owns an 18% interest (Tatex III), “engineers encountered a 5,000-foot-deep column of gas.” This should have reflected that engineers logged approximately 5,000 feet of apparent possible gas saturated column, which has not been tested for production as the well has not been completed. As of December 31, 2010, the Company has not booked any proved reserves attributable to its interests in Thailand. |

| • | The Article attributed to Mr. Palm a statement that its other Thai venture, in which it owns a 0.7% interest (Tatex II), “produces income of about $500,000 a year.” In 2010, 2009 and 2008, the Company received distributions from Tatex II of $565,000, $517,000 and $912,000, respectively, and paid cash calls of $0, $320,000 and $50,000, respectively. The Company paid a cash call of $402,000 in 2010 in connection with Tatex III and expects to invest approximately $1.0 million in Tatex III in 2011, which it expects to fund mostly from 2011 distributions from Tatex II. In 2010, the Company recognized small losses on its equity investment in Tatex II and Tatex III, as described in the Form 10-K. |

| • | The Article stated that the Company believes it has exposure to a specified large oil quantity through its 25% stake in the Grizzly Oil Sands venture, based on an analysis of 34% of the acreage. The oil quantity estimate was of total resources (and not reserves), which the SEC does not permit in SEC filings because it considers such estimates too speculative. The estimate should |

| not be construed as an indication of recoverable reserves. The Article also stated that “analysts say, production [once commenced from Grizzly] can continue for as much as 40 years.” The Company’s Grizzly Oil Sands venture is a complex project and financing has not been secured. This project may not be completed at the Company’s estimated cost or at all. |

Forward-Looking Statements

This free writing prospectus may include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These statements are based on certain assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments as well as other factors we believe are appropriate in the circumstances.

The Company has filed a registration statement (including a prospectus dated July 28, 2010 and a preliminary prospectus supplement dated March 21, 2011) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement, the preliminary prospectus supplement and other documents the Company has filed with the SEC for more complete information about the Company and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Company, any underwriter or any dealer participating in the offering will arrange to send you the prospectus and related prospectus supplement if you request it by calling Credit Suisse Securities (USA) LLC toll-free at 1-800-221-8863 or Johnson Rice & Company L.L.C. toll-free at 1-800-443-5924.

Exhibit A

Text of Article dated March 22, 2011 Published by Investor Business Daily

Gulfport Energy Finds Profit In Abandoned Fields

By Norm Alster, Investor’s Business Daily

Posted 03/22/2011 02:35 pm ET

Many companies have a profitable but slow-growing core business that throws off enough cash to support a long-term growth prospect or two.

But Gulfport Energy (GPOR) of Oklahoma City has a cash-cow oil production asset that is still growing smartly. And it has assembled a handful of promising long-term projects.

“For a company of its size, it has an unusually diverse portfolio of opportunities,” said Ron Mills, a partner with Johnson Rice.

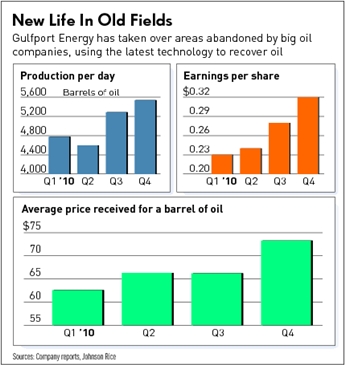

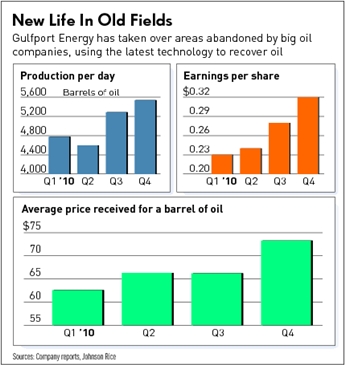

At this point, 85% of Gulfport’s production, which is mostly oil, comes from its properties in southern Louisiana. Like other small exploration and production outfits, it has been able to squeeze new life out of oil properties that no longer interest the majors.

“We go to a place where there is a tremendous resource in place. We use new technology to unlock this vast resource,” said Gulfport CEO James Palm.

In Louisiana, Gulfport bought old fields from Gulf Oil and Texaco and with the use of new 3-D seismic technology has extended their life, Palm says. “They considered them pretty worn out,” he added.

Premium Price

But those fields accounted for the bulk of Gulfport’s 5,400-barrel-a-day production last year. An added kicker: Gulfport’s Louisiana sweet crude commands a premium price, recently running as much as $15 higher than West Texas Intermediate crude.

Palm believes he can continue to increase Louisiana output. “We can continue to grow 20% to 25% in annual production out of southern Louisiana,” the CEO said.

That’s a healthy cash cow.

But it’s the newer projects in Gulfport’s portfolio that are creating the real excitement.

In Texas’ Permian Basin, where new horizontal drilling technologies have revived production, Gulfport has been snapping up leases. The Permian already accounts for 14% of Gulfport’s output, Mills says.

Gulfport began buying into the Permian in 2007, early in the current cycle. It now holds more than 14,000 net acres there. Mills sees the area providing “most of Gulfport’s growth for the foreseeable future.”

It’s the less foreseeable future that is most intriguing just now for Gulfport.

In Thailand, Gulfport has an 18% stake in what Palm believes is potentially “a world-class resource.” In drilling a 15,000-foot exploratory well, engineers encountered a 5,000-foot-deep column of gas.

“It’s promising,” Mills said. But he adds that engineers still have to “test the well to see if it flows.”

Gulfport already has a tiny 0.7% stake in a Thai gas project. It produces income of about $500,000 a year, Palm says.

At 18%, the stake in the new well could yield far greater returns. “We see it as every bit as promising as the earlier Thailand venture,” Palm said. “And we have a much larger stake.”

But, “we have so much to learn in the testing,” he cautioned. “It’s really difficult to project” the ultimate output. Should the wells produce, Gulfport will benefit from natural gas prices in Thailand, which are much higher than in the U.S.

Also creating excitement is Gulfport’s large stake in oil sands acreage in Canada’s Alberta province. Gulfport believes it has exposure to more than [estimated amount of potential resources deleted] through its 25% stake in the Grizzly Oil Sands venture. And that’s just based on an analysis of 34% of the acreage.

View Enlarged Image

So long as oil prices stay high, the oil sands venture should be a moneymaker. “You can make a good living in the oil sands at $75 oil,” Palm said. “In the 90s or 100s, it’s really great.”

Production won’t begin until early 2013 in any case. But once it does, analysts say, production can continue for as much as 40 years.

Some speculate that Gulfport will sell some of its Canadian assets. The major oil companies are attracted to these projects because they produce for so long.

Beyond the potential in Canada and Thailand, Gulfport is still investing in new U.S. acreage. It’s been building acreage positions in the Permian, in Colorado’s Niobrara and in the new Utica Shale play in Ohio.

Gulfport has roughly 19,000 acres in the Niobrara, where it also expects 3-D seismic technology to aid in recovery. Significant production is still a ways out. But, says Palm, “we really like the economics up there.”

New Area

In the Utica Shale, Gulfport has amassed more than 13,700 net acres. Palm doesn’t expect production there until late in next year’s first quarter. “It’s a new area,” the CEO said. Though the shale seems to hold a range of hydrocarbons including natural gas, “to us, it’s an oil play,” he said.

Developing all the major opportunities will require capital. Gulfport recently raised its capital budget for 2011 to $127 million-$133 million. Analysts say that the combination of strong cash flow and ample credit access should suffice to fund needed investment.

In relying on new technology to unlock “unconventional” oil plays, Gulfport is vulnerable on two scores.

The use of horizontal drilling in combination with hydraulic fracturing has raised persistent questions about the effect of such drilling on water supplies. The process requires huge torrents of chemical-laced waters.

And the newer techniques are already more costly. So oil prices must stay high to make recovery economical. So long as they do, Gulfport should be in good shape.